When I turned on the car this morning, I was met with 3 political ads in a row! I don’t know about you, but I’m already sick of them and we’re still six weeks out from the election. The amount of divisiveness that’s being caused and the animosity toward our fellow Americans is unacceptable.

When we’re dealing with challenging times like this, we always start with what we know as a fact (not emotions, feelings, or what we think is going to happen) and then focus on what we can control. Let’s start with what we know as it relates to investing during elections:

- The stock market is often more volatile leading up to the election. The markets love certainty and a political election is anything but certain. We’ve begun to see investment values pull back some over the last few weeks and don’t be surprised if this continues between now and election day.

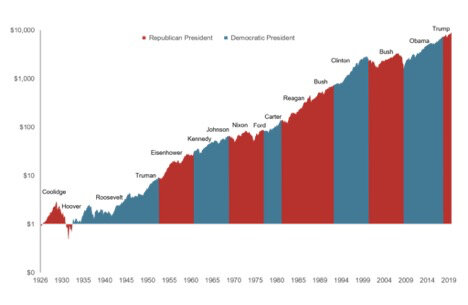

- As you can see in the chart below, it really doesn’t matter whether the president is a Republican or a Democrat. There are ups and downs, but the stock market almost always has a positive return over the presidential term.

- 3. News headlines are created to grab our attention! The media makes more money when it gets more eyeballs on their articles. I’m pretty sure each company is competing for who can be the most extreme so take everything with a big old grain of salt.

Now let’s move to what we can control:

- Make wise decisions – every financial theory and model assumes that we are rational when it comes to our decision making with our money. Nothing could be further from the truth! Emotions play a HUGE role and most of the time, our emotions lead us to make terrible financial decisions. The difference between a good or a bad decision can mean you have to work a few more years or skip that financial goal completely. If you’re nervous or just want to talk, don’t hesitate to reach out! That’s what we’re here for.

- Revisit your financial plan and investments – any time there is a change to your values, financial priorities, or goals, we should reevaluate your financial plan and investment to make sure they are all still aligned.

- Change our perspective – so often we focus on the short-term and how investments will react tomorrow, next week, or over the next month even though we’re investing for goals 5, 15, or even 30 years away. If we look at the chart of the stock market above, a broader perspective will remind us that investing works if we give it time.

We’re here to walk beside you as you deal with all the uncertainty and challenges life throws at you. Please reach out if there’s anything we can help you with.