7 Financial Resolutions

The year 2020 presented us with unique challenges. Never has a singular event had such wide-ranging repercussions as the Covid pandemic.

It has touched nearly every area of our lives—schooling, socializing, family gatherings, travel, and more. And the restraints from social distancing and restrictions implemented to slow the spread of Covid remain in place.

Of course, it wasn’t just our daily routines that were impacted. The economy and our investments saw unprecedented swings in 2020.

Yet, we are an optimistic nation. As the economy was set to climb out of a deep hole, investment legend Warren Buffett said, “I remain convinced…nothing can basically stop America. The American miracle, the American magic has always prevailed, and it will do so again.” (1)

Last year’s strong finish for stocks suggests Buffett is on the right track.

As we enter a new year, we tend to look back at our successes, our challenges, and new goals for the upcoming year. Without a doubt, we all faced challenges in 2020. But I believe we can all herald personal victories, too.

I’m convinced most of us are hopeful as we look to 2021. I know I am.

New Year’s resolutions are one tool that offers us guideposts as we begin the cycle anew. Surveys (2) say that more than half of adults make resolutions–yet, we know far fewer keep them.

The top two resolutions center on money and health. My goal is to keep things simple and realistic, focusing on resolutions for your finances.

I’ll offer you options. Some may seem simple, but the foundation of any financial plan must be built on the basics, the fundamentals.

Some may apply to you. Others may not. But I encourage you to grab hold of what is realistic.

7 financial resolutions to get you started in 2021

- Make a budget. You won’t know where your money is going until you track your expenses. You might be surprised how much you spend on various items. You’ll also find ways to reduce some expenditures. That puts and keeps money in your pocket.

Of course, some of us are saving due to the pandemic. We miss restaurants, concerts, movies and sporting events. But what new habits have we learned in 2020 that we can carry over into the new year?

- Establish an emergency fund. Nearly 30% of Americans don’t have savings for an emergency.(3) Start with the stimulus money Congress gifted you, and gradually save until you have at least three months you can set aside in the event of an emergency. Six months is optimal.

- Start or increase saving for retirement. Maybe you don’t think you can afford it. But let’s view this from another angle.

When an unexpected bill comes in, we always seem to find a way to pay for it. If your car breaks down, you know you’ll need to get it repaired. Look at retirement as your car that needs to be fixed.

One easy way is to sign up for automatic drafts into your 401k or IRA. Do you want to save 10% of your income? But does that goal seem out of reach? Then start with baby steps—two or three percent of income will be your starting point.

Then double it in April and increase it by the same amount in July. Continue every three months until you hit your goal. That’s how I began socking funds away for retirement.

- Pay down and pay off debt. You’ve created a budget, but debt continues to weigh on you like an anchor around your neck. You know the feeling.

Put away your credit cards until they are paid off. Pay more than the minimum balance and focus on high-cost debt first. When one card is paid off, put that payment towards your next loan. You’ll be surprised at the headway you’ll make.

And one more thing. When you’ve paid off a loan, reward yourself. Simple rewards are excellent incentives that keep you on track to the top of your summit.

- Keep debt reasonable. If you have all your credit card, student and auto loans paid off, you are ahead of the game. But just because you can borrow doesn’t mean you should.

Keep monthly outflows for your home below 28% of your pretax income and your total monthly debt payments (including credit card, mortgage, auto, and student loans) below 35% of your pretax income. These principles will help keep you on sound financial footing.

- Contribute to a cause near and dear to your heart. Consider incorporating regular financial gifts toward your favorite charity or charities. Can you set up an automatic draft? If so, even a few dollars each month means you will be making a difference. Or, you may choose to volunteer your time.

- Get your affairs in order. Finish setting up a will or trust, update your beneficiaries, update life insurance, and consider a living will. A living will reflects your preferences to close family or friends regarding end-of-life medical treatment. Also, consider a durable power of attorney, which allows someone to make health care decisions for you if you are incapable of doing it yourself.

The seven resolutions are simply guidelines and suggestions. Does it seem overwhelming? Then focus on one or two. Or, implement the ones that apply to you and tackle one per month.

If you have questions, we are no further away than a phone call or email.

We wish you a happy and prosperous New Year!

A Tribute to Our Veterans

What does November 11th mean to you? Just another Federal holiday? Unfortunately, to many Americans, we have forgotten the importance of Veterans Day.

In the midst of much turmoil of 2020, one can easily become numb to the fact that we, as Americans, enjoy the freedom that so many people throughout the world do not experience. Too often, we take our freedom for granted.

What has been the price of freedom? Men and women who were willing to sacrifice their lives, their time, their talent, their families so that America could remain free. Men and women who have served in all branches of the military to protect our freedom.

We honor those who have served with two special holidays in our wonderful country. Memorial Day is set aside in the month of May to honor and remember all who have paid the ultimate price of sacrifice that America may remain free.

Veterans Day is a day of celebration to honor America’s veterans for their patriotism, love of country, and willingness to serve and sacrifice for the common good.

At Franklin Watkins Financial Group, we are encouraging everyone to thank a veteran sometime in the next day or two. Because all that has happened and is taking place in America in 2020, we can easily grumble, complain, and forget the blessing we enjoy that is called freedom. We have this blessing of freedom because of our veterans. Let’s honor them. Let’s salute them. Let’s thank them because they deserve our appreciation and gratitude.

To all the veterans from Franklin Watkins Financial Group, we send a big THANK YOU. May God continue to bless America!

Role of Risk Management in Comprehensive Financial Planning

As we mentioned in the blog two weeks ago, there are six areas that should always be covered in a comprehensive financial plan. Those six parts are:

- Cash Flow

- Risk Management

- Tax Planning

- Retirement Planning

- Investments

- Estate Planning

Our goal with a comprehensive financial plan is to assess where you are today financially, where you want to be in the future, and the best strategies to get you there. We include risk management because it makes sure you are protected should something go wrong along the way.

With risk management, we focus on four key areas:

- Life insurance to protect your loved ones should you die prematurely

- Disability insurance to ensure you will still receive income should you no longer be able to work

- Long-term care insurance to protect your assets and provide dignity if you need this type of care in the future

- Property and Casualty insurance to protect your home and other possessions

There are two issues we see regularly with how people approach risk management. The first is making decisions based on how much you can afford. The correct approach is determining what coverage is needed to meet your goals and then building the correct coverage as part of your comprehensive financial plan.

The second is using rules of thumb or generic advice. Let’s dig into this in a bit more detail because this is more common. The rule of thumb for life insurance is 7-10x your income, but it needs to be tailored based on your situation. For example, let’s assume you’re a young doctor who just finished residency. You have $250,000 in student loans and a mortgage for the home you just bought. You have two young kids and your spouse in not working outside the home. This person would probably need closer to twenty times their income depending on their goals.

On the other hand, you’re 60 and have done a good job saving for retirement and paying down debt. This person might only need 3-5x their income in life insurance. Every situation is unique so when we review risk management in a comprehensive financial plan, it allows us to make sure the coverage is tailored to your needs. You’re not paying for insurance you don’t need and your loved ones will be taken care of should any unexpected events occur. That’s the goal!

Cash Flow Planning

As we mentioned in the blog last week, there are six areas that should always be covered in a comprehensive financial plan. Those six parts are:

- Cash Flow

- Risk Management

- Tax Planning

- Retirement Planning

- Investments

- Estate Planning

Over the next 6 weeks, we’re going to dig into each of these to cover why they must be included in a comprehensive financial plan. Today, we’re starting with cash flow because that is the core. The whole goal of financial planning is to visualize where you want to be in the future and determine the best strategies and ways to achieve those goals. If you’re spending more than you’re making, then it’s going to be impossible to make progress.

We begin by looking over the last few months of your cash flow to review what’s come in and what’s gone out. We then use this information to create a base spending plan. I don’t like to call it a budget because many people consider budget to be a bad word. They’ve been taught that budgeting is restrictive and always tells you no.

With a spending plan, the goal is to give you the freedom to spend money in the way that best aligns with your goals and values. If one of your priorities is retiring early, then we choose to allocate more funds to retirement savings. If you want to make sure your kids don’t come out of college with the same amount of student loans as you did, then we save more for college. If you’re willing to provide more experiences for your family today but work a little longer, then we move funds there. You’ll probably get sick of hearing me say this, but financial planning is all about prioritization. Your cash flow should reflect these priorities.

Once you’ve created a spending plan for your cash flow, tracking and accountability is key. I’m often asked what tool is best to help with tracking and my answer is the one that works for you. We have some clients who love a good spreadsheet. It’s tried and true and they know it works for them. Others have come to us using Quicken, Mint, or another digital tool. Our financial planning software has a feature to track this as well. My advice here is to find what works for you and stick with it.

Just like in other areas of life, accountability will play a massive role in keeping you on track. If you don’t have this, it’s so easy to make that exception that turns into a regular expense and derails your progress. Money can be a huge stressor in marriages or relationships, but your spouse or partner should be the person to help you with this since you’re doing life together each day. We are here to help with this as well.

To wrap this up, the whole goal of cash flow planning is to create enough margin each month where you can enjoy your life today but also make sufficient progress towards your financial goals.

What’s a Comprehensive Financial Plan?

If you look at just about every financial advisor firms’ website out there, it will state they provide comprehensive financial planning. The crazy thing is that nobody really understands what that means. October is National Financial Planning month so today I want to dig into what a comprehensive financial plan is.

Comprehensive financial planning is a multi-step process but I’m going to summarize it into 3 main steps:

- Organize your finances to understand where you are today. This includes your income expenses, assets, liabilities, insurance, etc.

- Visualize where you want to be in the future. This can also be called goal setting but the idea is to come up with concrete financial goals. This can include when you want to retire and how much income you want, purchasing a more expensive home, funding college for your kids, or taking that dream vacation.

- Create a plan to accomplish your goals.

Once we know where you are today (#1) and where you want to go (#2), then the financial strategies and options that are needed become a lot clearer.

Let’s take a step back for a moment – the whole goal of financial planning is to create the life you want. It’s not all about sacrificing for the future or enjoying as much as possible today. It’s a delicate balance between the two. Too often we see money as something that’s good or bad when we should see it as a tool.

A comprehensive financial plan should also cover all areas of your financial life but especially these six areas:

- Cash Flow

- Risk Management

- Tax Planning

- Retirement Planning

- Investments

- Estate Planning

If any of the 3 steps or 6 financial planning areas are missed, then it’s not comprehensive financial planning. Over the next 6 weeks, we’re going to dig into each of the 6 areas that should be a part of your financial plan. Make sure you check back each week to learn more.

Wait? There’s an Election?

When I turned on the car this morning, I was met with 3 political ads in a row! I don’t know about you, but I’m already sick of them and we’re still six weeks out from the election. The amount of divisiveness that’s being caused and the animosity toward our fellow Americans is unacceptable.

When we’re dealing with challenging times like this, we always start with what we know as a fact (not emotions, feelings, or what we think is going to happen) and then focus on what we can control. Let’s start with what we know as it relates to investing during elections:

- The stock market is often more volatile leading up to the election. The markets love certainty and a political election is anything but certain. We’ve begun to see investment values pull back some over the last few weeks and don’t be surprised if this continues between now and election day.

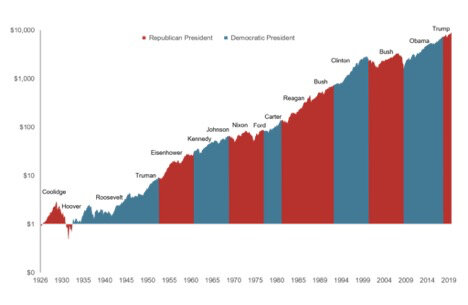

- As you can see in the chart below, it really doesn’t matter whether the president is a Republican or a Democrat. There are ups and downs, but the stock market almost always has a positive return over the presidential term.

- 3. News headlines are created to grab our attention! The media makes more money when it gets more eyeballs on their articles. I’m pretty sure each company is competing for who can be the most extreme so take everything with a big old grain of salt.

Now let’s move to what we can control:

- Make wise decisions – every financial theory and model assumes that we are rational when it comes to our decision making with our money. Nothing could be further from the truth! Emotions play a HUGE role and most of the time, our emotions lead us to make terrible financial decisions. The difference between a good or a bad decision can mean you have to work a few more years or skip that financial goal completely. If you’re nervous or just want to talk, don’t hesitate to reach out! That’s what we’re here for.

- Revisit your financial plan and investments – any time there is a change to your values, financial priorities, or goals, we should reevaluate your financial plan and investment to make sure they are all still aligned.

- Change our perspective – so often we focus on the short-term and how investments will react tomorrow, next week, or over the next month even though we’re investing for goals 5, 15, or even 30 years away. If we look at the chart of the stock market above, a broader perspective will remind us that investing works if we give it time.

We’re here to walk beside you as you deal with all the uncertainty and challenges life throws at you. Please reach out if there’s anything we can help you with.

College Savings Month

Have you ever wondered how you’re going to pay for your children to go to college? Or do you want to create a legacy of education for your grandchildren? September is college savings month so we wanted to devote some time on the blog to this topic. I’m going to focus on the different options you can use rather than discussing whether you should.

With that in mind, the most common way people are saving for college today is the 529 education savings account. Let’s dig into some of the key benefits of this account:

- This is an account where you can invest the funds to grow to pay for college costs in the future. Depending on which 529 account you use, the investment options will vary but they are typically mutual funds.

- The funds grow tax-free and are withdrawn tax free as long as they’re used to pay for qualified education expenses. This is a huge benefit and you can’t get this in any other account.

- You name your child, grandchild, or loved one as the beneficiary which means the funds are to be used for their educational benefit. There is some flexibility where if a child decided not to go to college or gets a scholarship, you can change the beneficiary to another direct family member.

- The 529 account can now be used to pay for K-12 private school in addition to college.

- The 529 account can now be used to pay for K-12 private school in addition to college.

- 529s receive favorable treatment when you’re applying for financial aid through the FAFSA.

1.College Foundation of North Carolina

a. This is the 529 account adopted by the state of NC.

b. It is a direct plan which means advisors cannot be involved or linked to your account. This keeps the costs low.

c. This plan is best for those who are comfortable managing the account themselves and picking investments.

a. The College America 529 plan is the state plan for Virginia. It doesn’t matter what state you live in or whether you choose your state’s plan as you can use funds in the VA plan to pay for college in NC, Florida, or Wyoming.

b. This plan does allow advisors to be involved so for those clients who want help setting up, choosing investments, and maintaining their account, this is an option we often use.

c. The costs are higher compared to the NC plan because an advisor is involved.

There are several other options for college savings that might be appropriate based on your situation. I’ll briefly mention each:

- Prepaid savings plan – with this option, you go ahead and prepay college today to lock in current prices. The beauty of this option is it’s already paid for and you don’t have to worry about how much costs increase between now and when your child goes to school. The main reason people don’t use it is because it does limit your child’s choices of where they can go to school.

- Investment Account – this is a great option for those who want ultimate flexibility. Inside this type of account, you can invest the money in just about any way you want and the money can be used for any purpose, not just limited to college. The downside compared to the 529 is there are no tax benefits. As you have dividends, income, or capital gains, you’d pay taxes on them annually.

- Roth IRAs – this option is a bit more nuanced because you’re using a retirement account. This option is frequently used by those who are trying to save for retirement but want to give them an option to use some of the funds for education if needed in the future. There are some very specific tax rules here so please talk to your CPA or other professional to learn more before choosing this option.

Let us know what questions you have or if you’d like to schedule a short call to learn more!

Life Insurance Awareness Month

How would your family survive financially if an accident happened and you die prematurely? Would they be forced to sell your home because they can’t afford the mortgage? How else would life change without your income?

Risk management is one of the six key areas that make up any comprehensive financial plan and today we want to focus on life insurance because September is life insurance awareness month.

I know – it’s never easy to discuss difficult topics like death but if these last few months have taught us anything, life is uncertain. Crazy things can happen at any time which is why it’s important to plan ahead.

Today I want to answer some of the key questions we regularly receive around life insurance:

What’s the purpose of life insurance?

Simply put, the purpose of life insurance is to protect your loved ones. If you have loved ones who are financially reliant on you, then you need life insurance. If you are reliant on your spouse’s income, then your spouse needs life insurance.

How much do I need?

The rule of thumb is typically 10-15x your income, but the answer should be more nuanced because your age and stage of life plays a significant role. If you’re the sole income earner for your family, you have young kids at home, and have a large mortgage and other debt, you might need more. If your kids are out of the home and you’ve already saved a significant amount for retirement, then you probably need less. It’s also not about how much you can afford. It ultimately boils down to what you want to protect against and it’s a math calculation from there. If you don’t know how much coverage you need to protect your family, don’t hesitate to reach out!

Is life insurance expensive?

Maybe – if you’re healthy, then most people are surprised by how cost efficient it is to buy a level term insurance policy. For example, for a health 35 year old man, a 20 year level term policy with a $1,000,000 death benefit can cost as little as $34/month. For a woman, the cost can be as low as $28.38/month.

Do I need more insurance than my employer provides?

Yes – most employers only offer a set amount of $50,000-100,000 or 1-2x your salary. As we mentioned above, most people need more than this to protect their loved ones. Many employers do offer the ability to purchase more coverage which can be helpful. One item to consider is many times the coverage through your employer is not portable so if you begin working for a new company, you can’t keep the life insurance coverage. If your health has changed for the worse, then you might not be able to buy insurance or at the very least, it will be more expensive. By purchasing your own policy outright rather than through your employer, it will ensure that you can keep the coverage no matter how many times you switch jobs during the term.

How often should I review my coverage?

We recommend reviewing your insurance coverage annually or as life changes. If you buy a new home or have a child, you should review your coverage.

If you have additional questions or need help analyzing how much insurance you need, please contact us and we’ll be happy to help!

Why Your Values are Integral to Financial Planning

Just the other day I was asked by a friend whether they’re saving enough for retirement. I jokingly replied, “I don’t know.” This answer applies when I’m asking about college savings, buying a vacation home, or any large financial goal.

The reason why I respond this way is because it ultimately boils down to what you value and therefore what you want to prioritize financially. We like to take our clients through a values exercise where we have a deck of cards and each card has a different value on it. A few examples are meaningful work, family, health, creativity, security, and service. In this exercise, we take the 50 different values and whittle them down to your top 5. This is always fascinating when doing with a couple to see how theirs are similar and different.

Once we know what your top 5 values are, we can prioritize your financial decisions based on the results. Let’s look at a few examples:

- You’re offered a great new job with a significant pay raise but increased stress and travel. If your top priorities are family and health, taking the job doesn’t make sense. However, if your top values are meaningful work and you’re able to express creativity through your work, taking the job is the right decision.

- You’re beginning to plan for your children’s college educations. If you graduated with significant student debt and want to leave a different legacy for your children, then you fund college more and know that you’ll have to work a few more years to make up for the lost retirement savings. If financial freedom for your retirement is most important, then you save for retirement and help your children find other ways to pay for college

What we find is our clients who align their money and their values are the happiest and most able to achieve their goals. If you’d like to discuss how this applies to you or do this values exercise, please contact us and we’ll be happy to help!

Three Labor Day Financial Tips

We’re going to keep the blog short and sweet this week with 3 ideas to improve your finances over this long, Labor Day weekend:

- Check your credit report – it’s amazing how many times incorrect or bad data is provided by one of the financial companies you work with to the credit bureaus. All three of the credit bureaus are required to provide you with a copy of your credit report for free annually and we recommend spacing them out over the course of a year. You can access the free reports at this link: www.annualcreditreport.com. Due to the financial uncertainty surrounding COVID-19, you are now able to access weekly reports of your credit through this website through April 2021.

- Review your budget – summer can be a challenging time for your spending plan with the kids out of school and possibly taking some family vacations. Take a few minutes this weekend to review your spending over the last few months and dial your budget back in so you can achieve your savings and investment goals before year end.

- The holidays are coming quickly – I don’t know about you, but if you’re like me, you always spend a bit more over the holidays. Buying gifts for loved ones, traveling to see them, or just paying that utility bill for all the lights we string up on the house all come with a cost. Spend a few minutes to look back at what you spend last year and start setting aside that money now. It’s always better to plan ahead rather than putting it on a credit card and it costing even more.

Happy Labor Day!

SUBSCRIBE

Sign up with your email address to receive news and updates.

We respect your privacy.